Recently I have been thinking about the strategy to apply during the second half of the year. There are quite a few issues making it very difficult: all time high valuations in general, EUR/USD exchange rates, political tensions, terrorism, brexit and Trump to mention few. Typically I consider such issues as a positive thing (in investment sense) as long as they produce the expected outcome which is fear and panic. A lot of that is missing though mainly due to politics on both sides of the pond but I’m pretty sure we will get there eventually. The problem is that nobody can tell when this will happen. I’m guessing that it will not happen during the second half of the year, maybe not even during 2017.

As the world lies at the moment, I’ll be considering mainly the following options for the second half: weapons, defence and security sector, alcohol and other similar substances and lastly car makers. For the weapons part I would really like to increase my position in LMT but I would like to get a bit better valuation and really don’t like the idea of converting euros to dollars with the current exchange rate. For the security part I could consider something like Securitas AB but it will require better analysis of the company details. For the alcohol part I have my eye on Olvi Plc. If the price hits my target during Q4, I most likely will open a position on it.

Car makers is a sector I have the most trouble with. I have been playing with this idea since the still ongoing VW scandal but perhaps with a bit different point of view, the overall sector valuation caused by the scandal was just a positive trigger. I’ve approached this mainly from the partially political electrification of transportation point of view. Pure electric cars is the obvious way to achieve it but personally I feel that it’s not the whole story. Some companies have been introducing fuel cell powered electric cars with moderate success but such companies are in minority and it’s easy to understand why. However, I’ll consider it to be a strategic position worth maintaining for now and here’s why: in the end it could be very much like with beta versus VHS back in the 80’s. No, not because of the porn industry but because of the infrastructure, user experience and even politics. It’s not very hard to envision the partly false appeal it would have: refuelling process would be essentially the same, less need for rare earth metals and there would still be a large job providing distribution and storage infrastructure in place which would be anyway needed for the transition period. And then there’s also the geographic factor which could make the fuel cell viable option e.g. for the northern hemisphere. True, much of this applies also for gas and even for EV recharging.

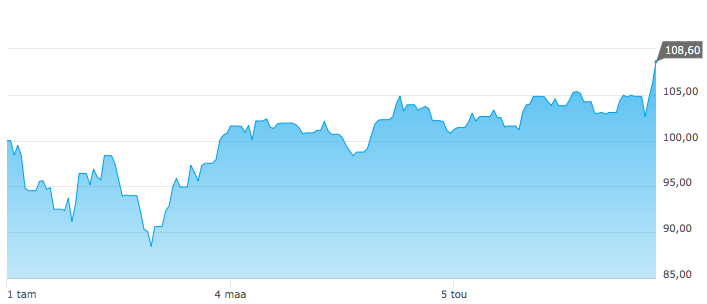

All this makes me wonder if a strategic position in fuel cell cars would be a nice to have feature in a EV capable car company waiting for technological breakthroughs in fuel cells and in battery technology. It could be a decent long term investment as long as the company can produce decent profits in current situation. In general this is a sector I don’t really like: very competitive low margin, labor intensive business with expensive unit prices. There really aren’t many companies capable to differentiate themselves expect for smaller companies like Tesla in which I will probably never invest in. They are pretty much all building relatively similar products using the same suppliers and repeating the process each year. On top of that they all depend on the overall economic situation which is somewhat dependant on the politics as well. Having said that, I’m still looking at Hyundai Motor Company for H2 with mixed feelings about the whole sector.