First of all, minor addition to Telia Company AB with a purchase of 100 shares for 3,832 EUR per share. Nothing special here, just a minor addition to what I believe to be a reasonably priced company with a strong dividend.

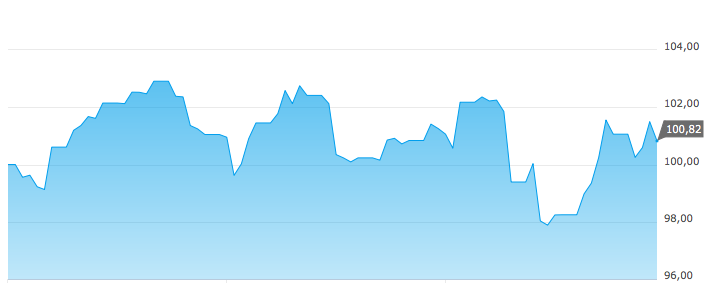

Then there’s yet another new position in the form of Yara International ASA. Entry position consists of 50 shares bought for 292,00 NOK per share. I’ve been thinking about a position on fertilizers for a while now to complement other cyclical positions. I consider it to be a segment which will benefit from multiple mega trends going forwards. It’s also a sector which most likely will see some consolidation, some of it already in progress. Yara operates in the major league within the sector and the overall cycle phase appears to be near enough to the bottom.

Link: Yara Investor Relations