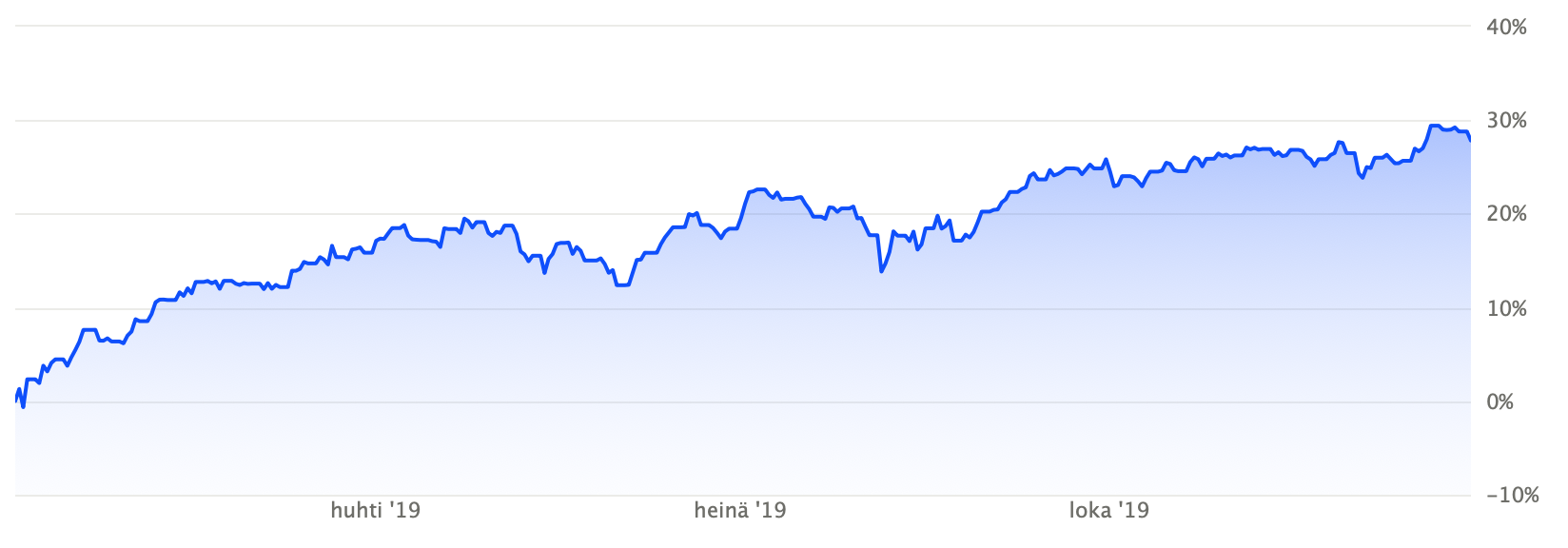

Another eventful year has passed. Global economy had some major setbacks such as the trade war, approaching US presidential elections with the internal issues that comes with it, the ever ongoing BREXIT saga and loads of smaller issues which I’m sure the middle east region will provide us for many years to come. Then there’s the situation with central banks and interest rates. Considering all this it’s really mind blowing to think how well stocks have performed. Portfolio value is really a secondary metric for me but primary portfolio value increased about 28% this year. This is somewhat in-line with index performance but this being an income oriented portfolio, unrealised capital gains are secondary but nice to have of course.

During FY2019 I re-arranged my personal finances and paid of my mortgage. For me this constitutes as the first step of three in the path to financial independence as it reduces significantly the required income for mandatory monthly expenses. In retrospect I probably should’n have sold some of the stocks for this (looking at Apple Inc. especially which has rallied since then) but these investments are done for a purpose and those realised profits filled their purpose in bigger picture. No hard feelings there especially since I very well realised that this could be exactly the outcome even for the Apple share.

Dividend income for FY2019 increased quite nicely compared to previous year. This happened even though I was not buying as aggressively as in year before due to decreased leverage on the portfolio. There were some one time extra dividends (BHP Billiton) and some negative news for next year as some of key positions will decrease the dividends next year (Nordea, Sampo). For FY2020 I expect consistent cash injections and full dividend re-investments which should offset those negatives and keep dividend growth trend in same trajectory. For FY2019 the total dividend income before taxes and converted to euros was 6769 EUR.

In the spirit of traditional new year’s resolutions I’ve set following goals for 2020:

- Personal savings rate of 70%

- Second step on the path to financial independence: passive income covers base consumption

- 12 months without alcoholic beverages

- Protecting effective tax rate (offset increased taxes with tax planning)