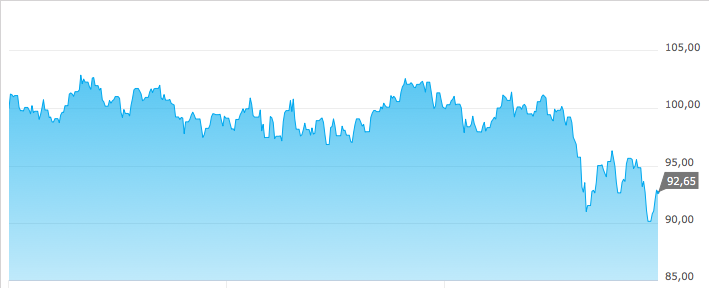

There are companies that tend to always trade with significant premiums. Sometimes it’s because of the undisputed quality and 3M Company sure fits that description. Today however we saw significant drop in the share price after slightly lowered guidance. I wasn’t really planning to buy anything especially since I already increased my stake in Philip Morris but since this is a rare occasion, I decided to open a new position with a purchase of 20 shares for 199,80 USD per share. This barely fits under the debt balance limit I’ve defined in my strategy but barely is enough in this case.

See: https://seekingalpha.com/news/3347916-3m-slips-lowering-guidance-range