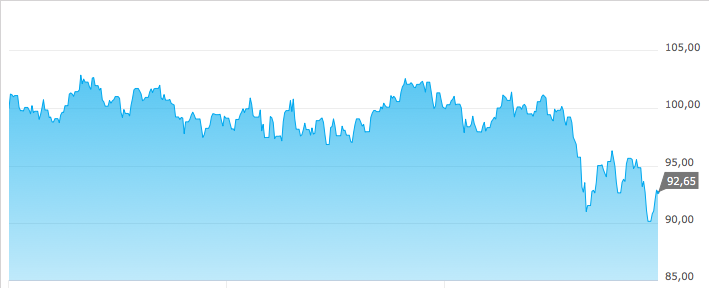

First quarter was red one and surprisingly full of event as the trade war rhetoric increased towards the end of the quarter. Other than that there wasn’t really major changes in the portfolio – mainly unplanned Apple and Citycon purchases, exits from General Mills and Yara and move into portfolio maintenance mode. In general these events have been the long awaited for market correction – on personal level that is. Global economy will be hurt from such stupidity but it’s robust enough to survive the way it always has. Meanwhile we are getting closer to valuations triggering once again multiple purchases. Let’s see if we get there during the next quarter, until then I’ll remain in maintenance mode.

Dividend income increased quite nicely from 929,31 EUR to 1 224,73 EUR (before taxes). This consisted of new purchases but also from quite solid dividend increases from existing positions. This dividend income together with new capital has reduced the portfolio debt quite quickly. If there are no surprises I expected to eliminate portfolio debt during third quarter.